The ID Co. Launch Income Verification Solution

The ID Co. Launch Income Verification Solution

Global FinTech, The ID Co. has today announced the launch of its pioneering Income Verification solution.

Using bank data and unique algorithms built on the comprehensive data-set acquired by The ID Co., the company has worked with lenders to build a solution that gives an accurate assessment of an applicant's income.

Verifying income is vitally important for banks and lenders, ensuring they have an accurate view of applicant’s financial income prior to awarding credit in order to ensure they are lending responsibly and offsetting any future risk of bad debt.

The ID Co.’s Income Verification solution allows lenders to seamlessly onboard new customers, removing friction in the application process, and giving lenders all the bank data they require to make a sound credit decision in seconds.

Presenting an applicant’s income using bank data, banks and lenders can make enormous savings in operational costs. Without having to obtain paper-based bank statements from applicants, lenders can begin assessing an applicant’s details immediately.

The solution gives a sound basis for lending decisions, ensuring there is confidence in the ability of the applicant to repay the loan. The tool also gives additional insights such as showing material supplemental income and whether the applicant’s income changes over time.

By understanding exactly how much income an applicant has, financial service firms will be in a position to make better assessments around disposable income, therefore protecting themselves from applicants who are unable to make repayments, or those that pose a bad credit risk.

The ID Co.’s Income Verification solution can help consumers with thin credit files, or those who have newly arrived in the country and do not have a credit history. An ability to illustrate what their income is and show that they have been in receipt of it over a period of time will give lenders confidence in applicants ability to repay. This will also open up a new prospect pool for lenders.

Banks are continually tested in their fight against financial crime, and verified income can help them win this battle, as it mitigates against potential fraud associated with paper-based statements.

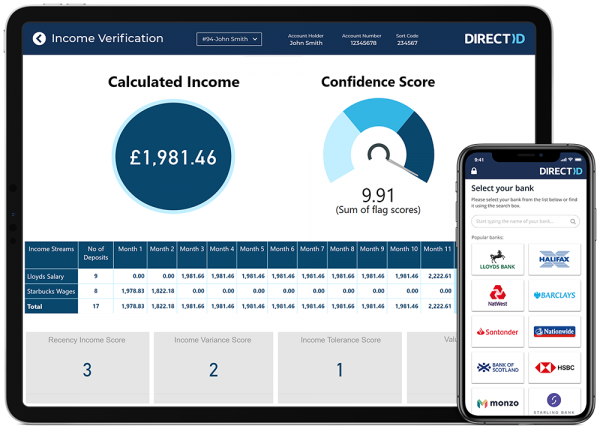

Our next generation Income Verification solution goes beyond the models of the past, using real-time bank data and six unique algorithms to truly understand an individual's income and the stability of that income.

Applicants transaction data is run through our Income Verification API. The result will be a calculated salary amount, with the option to include benefits, giving a confidence score.

Helen Stewart, Product Owner at The ID Co, said:

“We’re delighted to launch our Income Verification tool. We've known for some time that this would be of value to banks and lenders and have worked tirelessly to ensure that this product fits their requirements. The capabilities we have built in to give a confidence score is unique in the market and has been developed over many months of hard work. The solution has already been highly commended by banks and lenders that have trialled using it.”

James Varga, CEO of The ID Co., added:

“Once again, the capabilities of bank data have allowed us to build a new tool that is unrivalled and unparalleled anywhere in the market. We know the challenges that banks and lenders have in accurately establishing applicant income, and now, using our experience in bank data we have a solution that will present this information in mere seconds.

“The operational savings in time and resource this could provide for banks and lenders is immense. Combined with the ability for seamless onboarding and responsible lending I would strongly encourage anyone who requires accurate income information to visit The ID Co. website for more details.”